Recently many valid questions were raised about ESG, but some experts are skeptical about the whole approach. Although, the need for companies to understand their external environment and address it adequately now is more crucial than ever. This article is devoted to discussing the future of ESG and why it is here to stay despite the criticism.

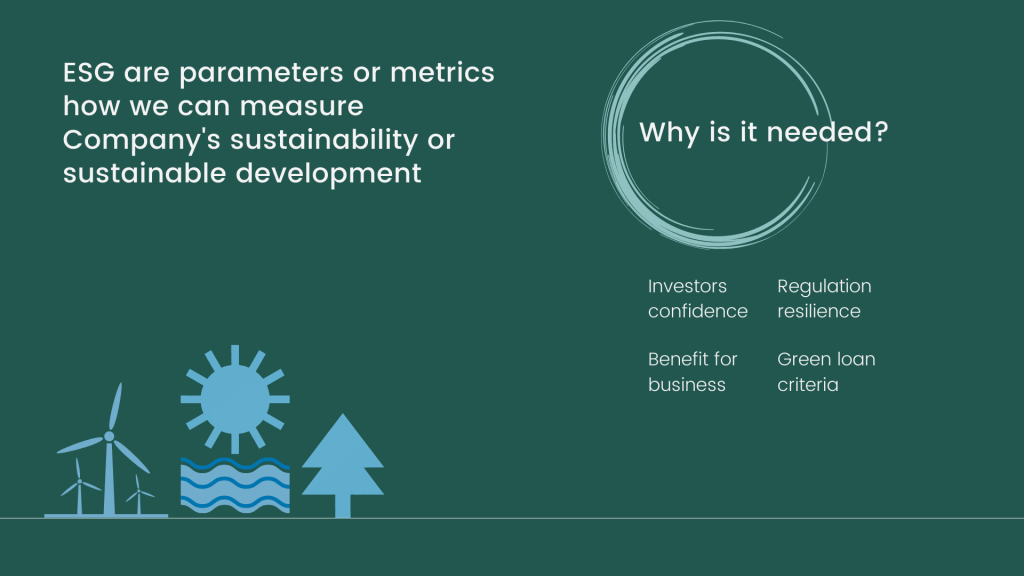

Let me briefly explain what ESG is and why it is important to talk about it. ESG are metrics or criteria for how we can measure a company’s sustainability or sustainable development. ESG acronym stands for environmental, social, and governance aspects of business management. It is essential to disclose ESG information for different reasons. Firstly, to make investors confident in their business portfolio. Investors are very much interested in the ESG profile of companies. However, the rate of new investments has recently been falling. Investments into sustainable funds rose from 5 billion USD in 2018 to 87 billion USD in the first quarter of 2022, followed by another 33 billion USD in the second quarter. The EU taxonomy for sustainable activities is a classification system established to clarify which investments are environmentally sustainable in the context of the European Green Deal. The taxonomy aims to prevent greenwashing and to help investors make greener choices. The Taxonomy determines what is and what is not “green.” Since investors need to report how much of their finance is allocated within sustainable businesses, ESG is vital for reporting that. In the US, the Securities and Exchange Commission (SEC) announced the work on the new set of rules for detailed disclosure of climate-related risks and greenhouse gas (GHG) emissions.

Secondly, ESG makes a company resilient to regulation because we can all rest assured that more and more laws and policies are becoming sustainability-related. It would require considerable resources to come up with ESG metrics “overnight,” so it is necessary to start it now to protect a business in the future. Next, ESG undoubtedly brings many benefits for businesses. For example, a company is within someone’s else supply chain, and the primary customer enrolls new requirements for the procurement process. A supplier on a sustainable development track can get better contact conditions. Back to my previous article about sustainable trends – customers choose environmentally responsible companies which can communicate their values through ESG reporting. ESG makes a company eligible for green loans and bonds criteria as well. Banks offer better deals for those companies that follow ESG requirements. This also works for companies’ clients. For example, banks offer lower interest rates and no charge for paperwork if a client applies for a mortgage of energy-efficient houses.

ESG popularity across businesses has steadily grown since it was defined in 2005. According to McKinsey, an internet search for ESG increased five times since 2019, and searches for CSR (corporate social responsibility) have declined. Companies of different sizes across different industries and geographies allocate more resources with the primary goal of improving their ESG performance. More than 90% of S&P 500 companies now use ESG reporting of a different kind, and around 70% of Russell 1000 companies do the same.

Russia’s invasion to Ukraine and ensuing human tragedy, together with cumulative economic, geopolitical and social impact, consequently bring ESG into question. We may need to extract more fossil fuel and use it immediately to deal with the energy crisis. The net-zero transition may require an even stronger collaboration between countries while its leaders are preoccupied with war. So many companies are making impactful decisions to abort operations in Russia and trying to protect employees, and provisioning unprecedented levels of relief. Companies are doing so by addressing the social agenda. Some can tell that importance of ESG for businesses has peaked. Others criticize and doubt its necessity. Although, such criticism hasn’t developed recently as there are some common areas of objection.

First, ESG usually stays in a way for what businesses are supposed to be in the very first place – make as much money as possible. Following the ESG agenda looks suitable for a brand name, but it has little to do with business strategy. Second, finding a balance between E, S, and G among stakeholders could be too complicated. Again, by maximizing the value of a company, many trade-offs could come in place, and shareholders wouldn’t always be prone to changes in strategic vision. Next, it is almost impossible to measure ESG, or at least to some degree where different reports from different companies would be comparable. Of course, there are some common approaches, standards, and ratings, and we can technically measure some components of E, S, and G separately. However, aggregated ESG scoring is tough to interpret for further implementation. Different organizations can measure ESG events differently. For example, the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) evaluate employee training by finance amounts invested in training in the GRI case and by training hours in the SASB approach. Another argument against ESG is that it has little to do with financial results. Even if researchers find a correlation between ESG metrics and a company’s financial performance, this trend can be explained by multiple alternative factors.

On the contrary, in the ocean of metrics, estimates, targets, and benchmarks, companies can miss the very point of why they measure in the first place: to make an endurance for businesses with social support and in a sustainable, environmentally friendly way.

Firstly, more people who are not immediately involved with a company experience the consequences of its operations. GHG emissions, suppliers safety and health, and impact on manufacturing become interrelated for many industries and companies. Small local companies and huge multinational corporations now have to prioritize the same issues because the labor market requires action. Employees choose between their current company and competing employer following diversity and inclusivity agenda. Second, there are indeed many great companies that embed ESG in their business and succeed out there. If a company has a purpose in its business model, it can create value from its values. One example standing out is Patagonia, a US-based outdoor clothing and equipment retailer. They have always been driven by passion, and its founder Yvon Chouinard repeatedly reminded that he is in the business of saving our home planet. Another pertinent point is that current ESG metrics improve over time. Ratings such as MSCI, Refinitiv, S&P Global, and Sustainalytics tend to consolidate the disclosure framework and compete for standards of ESG performance measurement.

To conclude today’s article, it is essential to understand that even if some initial meaning of ESG has changed over time, there are significant impacts and values behind this acronym. It can help businesses to have a meaningful influence over the long term, and it is vital to remain long time oriented in these turbulent days.

Some inspirational ideas: